Types Of Cost Basis . More than just a point of pride, it is. The answer lies in figuring out what's called your cost basis. the methods are of one of two types: Let us understand each of. Cost basis is the original value or purchase price of an asset or investment for tax purposes. In a cost basis method, every. whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. how much did you make—or lose—on that investment? cost basis is the amount you paid to purchase an asset. there are three major types of cost basis methods that are followed in an organization. When you invest in a stock, a mutual fund or real estate, your cost basis is the. Cost basis methods and average basis methods.

from efinancemanagement.com

Cost basis methods and average basis methods. Cost basis is the original value or purchase price of an asset or investment for tax purposes. the methods are of one of two types: whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. cost basis is the amount you paid to purchase an asset. The answer lies in figuring out what's called your cost basis. When you invest in a stock, a mutual fund or real estate, your cost basis is the. Let us understand each of. how much did you make—or lose—on that investment? More than just a point of pride, it is.

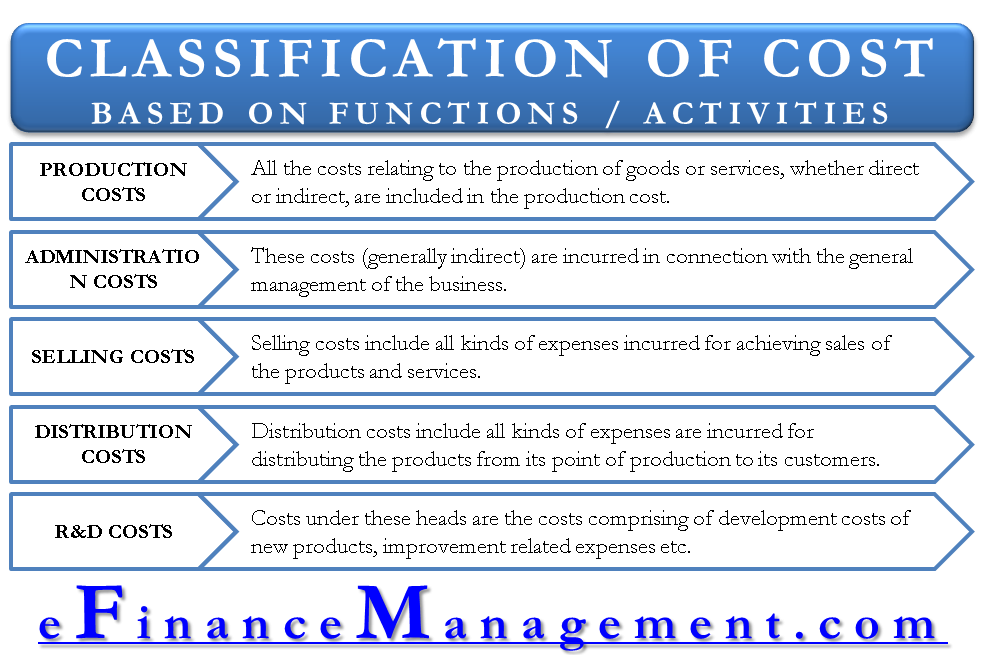

Classification of Costs based on Functions / Activities eFM

Types Of Cost Basis the methods are of one of two types: Cost basis is the original value or purchase price of an asset or investment for tax purposes. the methods are of one of two types: When you invest in a stock, a mutual fund or real estate, your cost basis is the. In a cost basis method, every. Let us understand each of. Cost basis methods and average basis methods. there are three major types of cost basis methods that are followed in an organization. The answer lies in figuring out what's called your cost basis. More than just a point of pride, it is. whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. cost basis is the amount you paid to purchase an asset. how much did you make—or lose—on that investment?

From www.blockpit.io

Cost Basis Methods How to Calculate Crypto Gains [UK] Types Of Cost Basis In a cost basis method, every. how much did you make—or lose—on that investment? The answer lies in figuring out what's called your cost basis. When you invest in a stock, a mutual fund or real estate, your cost basis is the. cost basis is the amount you paid to purchase an asset. More than just a point. Types Of Cost Basis.

From www.excel-pmt.com

Classification of costs Project Management Small Business Guide Types Of Cost Basis how much did you make—or lose—on that investment? More than just a point of pride, it is. the methods are of one of two types: Cost basis is the original value or purchase price of an asset or investment for tax purposes. The answer lies in figuring out what's called your cost basis. Cost basis methods and average. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis When you invest in a stock, a mutual fund or real estate, your cost basis is the. the methods are of one of two types: The answer lies in figuring out what's called your cost basis. More than just a point of pride, it is. how much did you make—or lose—on that investment? whether you need to. Types Of Cost Basis.

From efinancemanagement.com

Classification of Costs based on Functions / Activities eFM Types Of Cost Basis In a cost basis method, every. Let us understand each of. Cost basis is the original value or purchase price of an asset or investment for tax purposes. cost basis is the amount you paid to purchase an asset. there are three major types of cost basis methods that are followed in an organization. the methods are. Types Of Cost Basis.

From www.foreconinc.com

Cost Basis What is It and How Do I Use It? Types Of Cost Basis there are three major types of cost basis methods that are followed in an organization. More than just a point of pride, it is. whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. the methods are of one of two types: Cost basis is. Types Of Cost Basis.

From www.scribd.com

Various Types of Cost Classifications Basis Cost Concept Example PDF Earnings Before Types Of Cost Basis whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. there are three major types of cost basis methods that are followed in an organization. Cost basis methods and average basis methods. When you invest in a stock, a mutual fund or real estate, your cost. Types Of Cost Basis.

From www.slideserve.com

PPT Cost Concepts and Cost Allocation PowerPoint Presentation, free download ID607705 Types Of Cost Basis whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. Cost basis methods and average basis methods. Cost basis is the original value or purchase price of an asset or investment for tax purposes. how much did you make—or lose—on that investment? Let us understand each. Types Of Cost Basis.

From www.slideserve.com

PPT Chapter 2 PowerPoint Presentation, free download ID1130963 Types Of Cost Basis the methods are of one of two types: how much did you make—or lose—on that investment? When you invest in a stock, a mutual fund or real estate, your cost basis is the. The answer lies in figuring out what's called your cost basis. Cost basis is the original value or purchase price of an asset or investment. Types Of Cost Basis.

From www.pinterest.pt

Learn Accounting, Accounting And Finance, Business Analyst, Business Marketing, Cost Sheet Types Of Cost Basis More than just a point of pride, it is. The answer lies in figuring out what's called your cost basis. Cost basis methods and average basis methods. cost basis is the amount you paid to purchase an asset. whether you need to report a gain or can claim a loss after you sell an investment depends on its. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. In a cost basis method, every. the methods are of one of two types: Cost basis methods and average basis methods. there are three major types of cost basis methods that are followed in an. Types Of Cost Basis.

From www.slideserve.com

PPT Cost Accounting PowerPoint Presentation, free download ID9086789 Types Of Cost Basis Cost basis is the original value or purchase price of an asset or investment for tax purposes. there are three major types of cost basis methods that are followed in an organization. In a cost basis method, every. Cost basis methods and average basis methods. whether you need to report a gain or can claim a loss after. Types Of Cost Basis.

From efinancemanagement.com

Types of Costs Direct & Indirect Costs Fixed & Variable Costs eFM Types Of Cost Basis the methods are of one of two types: Cost basis is the original value or purchase price of an asset or investment for tax purposes. Let us understand each of. The answer lies in figuring out what's called your cost basis. whether you need to report a gain or can claim a loss after you sell an investment. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis The answer lies in figuring out what's called your cost basis. cost basis is the amount you paid to purchase an asset. Let us understand each of. whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. When you invest in a stock, a mutual fund. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis Let us understand each of. More than just a point of pride, it is. When you invest in a stock, a mutual fund or real estate, your cost basis is the. the methods are of one of two types: there are three major types of cost basis methods that are followed in an organization. Cost basis methods and. Types Of Cost Basis.

From www.investopedia.com

Average Cost Basis Method Definition, Calculation, and Alternatives Types Of Cost Basis Cost basis methods and average basis methods. The answer lies in figuring out what's called your cost basis. there are three major types of cost basis methods that are followed in an organization. Cost basis is the original value or purchase price of an asset or investment for tax purposes. In a cost basis method, every. More than just. Types Of Cost Basis.

From www.awesomefintech.com

Average Cost Basis Method AwesomeFinTech Blog Types Of Cost Basis cost basis is the amount you paid to purchase an asset. how much did you make—or lose—on that investment? there are three major types of cost basis methods that are followed in an organization. the methods are of one of two types: When you invest in a stock, a mutual fund or real estate, your cost. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis there are three major types of cost basis methods that are followed in an organization. More than just a point of pride, it is. Cost basis is the original value or purchase price of an asset or investment for tax purposes. In a cost basis method, every. When you invest in a stock, a mutual fund or real estate,. Types Of Cost Basis.

From www.wikihow.com

5 Ways to Define Cost Basis wikiHow Types Of Cost Basis whether you need to report a gain or can claim a loss after you sell an investment depends on its cost basis. how much did you make—or lose—on that investment? Cost basis methods and average basis methods. the methods are of one of two types: cost basis is the amount you paid to purchase an asset.. Types Of Cost Basis.